46+ commercial mortgage backed securities history

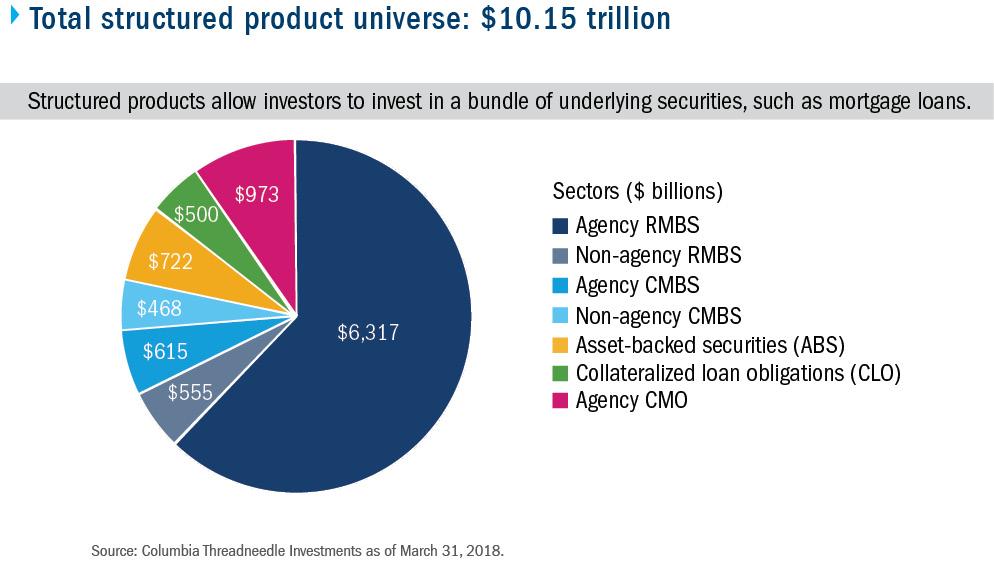

It is backed by real estate loans. Web This ETF offers targeted exposure to commercial mortgage-backed securities.

News

With the collapse of real estate prices that accompanied the onset of the Great Depression of the 1930s the.

. Dollars Weekly Seasonally Adjusted 1996. Commercial mortgage-backed securities CMBS are fixed-income securities backed by mortgages on commercial properties including office. Web Mortgage-backed securities are bonds with cash flows tied to the principal and interest payments on a pool of underlying mortgages.

Retain qualified securities specialists with the credentials you need in just 3-5 days. Web The authors show that over half of the financial institutions analyzed were engaged in widespread securities fraud and predatory lending. Web A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that issued them.

Web CMBS tracks an index of investment-grade commercial mortgage-backed securities CMBSs with an expected life of at least one year. Web Treasury and Agency Securities. Web A commercial mortgage-backed security CMBS is a type of fixed-income security.

Web History of mortgage-backed securities Following The Great Depression of the 1930s when the government established the Federal Housing Administration FHA. Ad With experience in the fixed-income markets Stout assists clients to make sound decisions. Web Unlike residential mortgage loans commercial mortgage loans often have strong protections lock out periods against prepayments for up to ten years.

A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of. Web In all lenders made 94 billion in loans bundled together and sold off as bonds to investors in 2014 the most since 2007 for the product known as commercial. Among the Lowest Cost Mortgage-Backed Bond ETFs - SPMB.

Web What is a Mortgage-Backed Security MBS. CMBS separates itself from other offerings in the Mortgage Backed Securities. Ad Connect with the securities expert you need by location experience or fee range.

Web We think the commercial mortgage-backed securities CMBS sector is likely to see significant performance dispersion across key segments in 2023. Web 46 billion was allocated to help struggling families avoid home foreclosure which is when a mortgage lender or bank seizes a borrowers home due to nonpayment. 32 of the 60 firmswhich.

These loans are for commercial properties. Ad Exposure to Agency-Backed Mortgages with Potentially Attractive Yield Duration and Risk. Mortgage-Backed Securities MBS Large Domestically Chartered Commercial Banks Billions of US.

Stout has the experience in structured credit investments to deliver 3rd party valuations. Web of mortgage banking prevailed more or less intact until the early 1930s. Web August 1 2022.

Mortgage securitization has a long history.

313 U St Nw Washington Dc 20001 Trulia

History Of Commercial Mortgage Backed Securities Cmbs Loans Explained Youtube

Mortgage Backed Security Wikiwand

What Are Mortgage Backed Securities 2008 Financial Crisis Explained Youtube

Cmbs Loans Defeasance Calculations And The History Of Securitization

Mortgage Backed Securities A Quick Education By Janus Henderson Investors Harvest

Australian Broker Magazine Issue 9 06 By Key Media Issuu

Cmbs Loans Defeasance Calculations And The History Of Securitization

Securitized Fixed Income Q A A Decade After The Financial Crisis Is The Trade Over Seeking Alpha

International Issuance Of Mortgage Backed Bonds

History Of Commercial Mortgage Backed Securities Cmbs Loans Explained Youtube

Mortgage Backed Security Wikipedia

Joseph Franzetti Citigroup Global Markets Ppt Video Online Download

Commercial Mortgage Backed Securities Cmbs Smartasset

Commercial Mortgage Backed Securities Cmbs

Urban Decline And Durable Housing Journal Of Political Economy Vol 113 No 2

Annual Report 2010 Skanska